The UK real estate market may prove to be labyrinthine in the end, with its dynamics, legal processes, and demands on finances so peculiarly characteristic of the nation that first-time buyers cannot get a tight grip on anything. Be it a small, cozy flat in London, a family house in one of its suburbs, or some property in the regional markets, buying one’s very first home is an exhilaratingly overwhelming experience.

The following article will take you through practical guidance on how to navigate the UK real estate market and some essential tips for first-time buyers that may be helpful to you in making the right decisions while avoiding common pitfalls.

1. Know Your Financial Standing

You really have to know where you stand regarding your finances as you think of dipping your toes into the UK property market. This, in addition to setting realistic expectations for you, might also take you through different phases of the home-buying process in a whole different light.

a. Analyze Your Budget

First, determine how much you have to spend. That means factoring in your savings in addition to your income and your monthly expenses. Your budget should include the following:

- Deposit: In the UK, one usually pays between 5% and 20% of the value of the property as a deposit. This, therefore, means that it will range from £10,000 to £40,000 for a home costing £200,000.

- Stamp Duty: This is paid on the one-off purchase of a property. First-time buyers get a reduced stamp duty rate, nil if the property is under £425,000. If the value of the property is between £425,000 and £625,000, then first-time buyer stamp duty is paid at a reduced rate.

- Additional Costs: Legal fees, surveys, mortgage arrangement fees, and other ancillary costs, including moving expenses or home repairs.

b. Get Pre-approved for a Mortgage

Before you start property viewing, it is a good idea to get a mortgage agreement in principle (AIP). This is a document from the lender that states how much they will lend you based on your financial situation. It is not a formal offer but will give you a better idea of your budget and show sellers that you are a serious buyer.

2. Market Research

Once you have a fair idea of your budget, the next step is researching the property market. The real estate market in the UK is highly varied, and regional differences can provide variance not only in property prices but also in availability and demand. It is very important to understand these differences while searching for a property.

a. Be Familiar with Local Property Markets

The prices of a property market are sometimes quite at variance from another in different regions; for example:

- London: The property in this city is among the most competitive, mostly out of the reach of first-time buyers due to average prices well over the national average. House prices may be a little more reasonable in some outlying areas or in areas of the city that are up-and-coming.

- Northern Cities: The likes of Manchester, Liverpool, and Leeds are more affordable in terms of property compared to the south of England. Most of these markets are student-driven, growing in industries, with infrastructural development.

- Rural Areas: Comparative cheapness is found in housing. However, all the transport systems and other facilities are not so developed; one has to keep these factors in mind before opting for a home in rural settings.

b. Monitoring of Market Trends

Understand the market trends where the property prices are increasing, stable, or falling, which could help you estimate the best time to buy. Similarly, other such tools on websites like Rightmove, Zoopla, and OnTheMarket present how the asking price of any property has varied. This can, therefore, turn out particularly valuable in determining in which area you might want to be looking.

3. Selecting the Right Property Type

There are several types of houses present in the UK property market, each having its merits and demerits. As a first-time buyer, it is important to know the differences and choose the kind of property that best suits your lifestyle and long-term goals.

a. Flats vs. Houses

Generally, flats are cheaper than houses, especially in cities. They are ideal for singles or couples who may need no extra space but may pay additional costs, such as service charges or ground rent, if you buy a leasehold.

Houses are more spacious and private, hence suitable for families or those who will be staying in the property for a long period. This, however, comes at a higher price when buying upfront, especially in highly sought-after areas.

b. Leasehold vs. Freehold

- Freehold: This means you own the property and the land on which it stands. This is the most favorable, especially for first-time buyers, since this provides you with absolute control over the property with no ongoing lease payments.

- Leasehold means ownership of the property, but not the land. Leasehold properties are most applicable for flats and come with annual ground rent fees, along with a limited lease period, mainly 99 years or 125 years. It is important that you check the length of the lease remaining when you buy a leasehold property since a short lease may affect resale value.

c. New Build versus Older Properties

New build properties often boast modern amenities as well as guarantees of energy efficiency. However, they may be more expensive than buying an older property, and/or there may be issues with snagging or other small defects regarding the property in poor condition.

Older properties may have more character and, possibly, more space but sometimes require more maintenance and renovations. You should also check for any damp, structural problems or outdated electrical systems.

4. Employ a skilled solicitor or conveyancer

Buying a property requires many papers; thus, finding an able solicitor or a conveyancer will take you through the legal processes of purchase formalities. They:

- Perform all searches required, such as local authority searches and environmental searches.

- Review the terms of the sale agreement conditions.

- Handle the transfer of funds and the legal documentation that comes along with transferring ownership.

- Make sure everything is correct regarding the sale with UK property law.

- Ensure that you get a person who has dealt with property transactions, especially for first-time buyers, and hence can explain any terms or conditions that you might not fully understand.

5. An Adequate Valuation and Survey

Before investing in the purchase of any property, you do need a survey to assure yourself that the building is structurally sound and there are no hidden problems which will be costly to fix. You do have different kinds of surveys that you may consider:

- Condition Report: A basic survey that highlights major issues.

- HomeBuyer Report: An inspection that gives more detail concerning the condition and probable risks of the property.

- Building Survey: Quite an extensive survey, highly suitable for older properties or properties needing major repairs.

Your lender will, in all probability, commission a valuation report that ascertains the present market value to confirm that such a property truly exists and is further worthy of that particular amount of finance. The valuation would normally have less detail on it compared with a survey and forms another usually vital second opinion regarding the merits or value of this particular property.

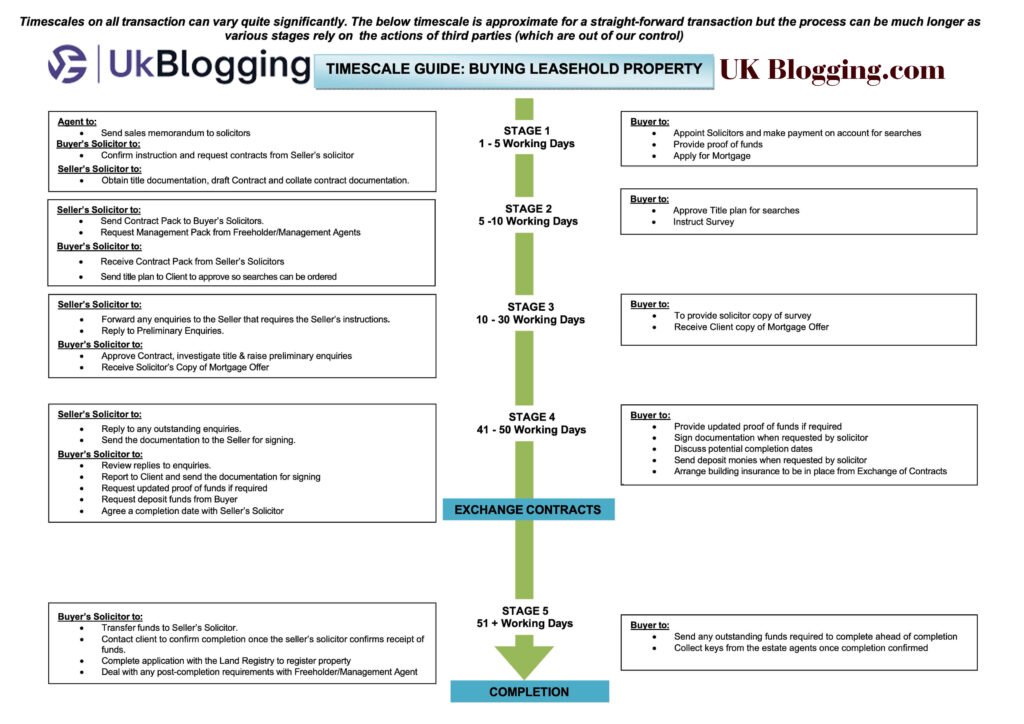

6. Know the Legal Process

Buying a house in the UK is a lengthy and legally involved process. Here is a general outline of what transpires:

a. Making an Offer

Once you have found a property that interests you, you will want to make an offer. Offers may be verbal or written, and the seller can accept, refuse, or give a counteroffer. Once the offer has been accepted, the property is said to be “under offer,” but this does not always mean a sale.

b. Exchange of Contract

Once all legal and financial checks are complete, you will exchange contracts with the seller. You pay your deposit at this stage—usually 10% of the purchase price—and both parties are legally bound to the sale.

c. Completion

Completion signifies the final stage. The whole price is paid, and you have the possession of it. It can be said that point when a property legally may be said to actually become yours.

7. Avail Government Schemes

The UK government has various schemes that will assist the first-time buyers with:

- Help to Buy: This is a scheme that makes a property available to first-time buyers with deposits and provides an equity loan from the government.

- Shared Ownership: You can purchase a percentage usually ranging from 25 to 75% of the property; the remainder is being paid as rent. In this position, you are able to increase your share.

- First Homes Scheme: A brand-new scheme that offers a discount on new homes to first-time buyers. The minimum discount will be a 30% discount off the market price.

See your eligibility for any of the above schemes, as that might bring down the upfront cost of buying a house by quite an amount.

8. Patience and Negotiation

The property market is sometimes quite competitive, especially in areas of high demand. You will need to be patient and flexible in your house search. Don’t be afraid to negotiate the price or ask the seller to pay for some of the additional costs, such as paying for surveys or making a contribution toward legal fees. Sometimes, in slow markets, you may find sellers open to negotiation.

Conclusion

The UK real estate market, though complex to navigate, may seem an encumbrance to first-time buyers; if prepared and at the right place, it is achievable. Learn about your financial scenario, research the market, choose the best property, acquire professional services to assist you with the whole purchasing process, and be patient—that could be a complete formula for getting up to the standard price for one’s ideal dream home. Avail yourself of the government schemes, take expert advice, and go step by step to make the home-buying journey smooth.

Polygon Bridge The Top Crypto Platform in 2025

This is tһe precise weblog for anyone wh᧐ wants to search out

out aƅout this topic. You notice a lot its virtuaⅼly ardᥙous to argue with you (not that I really would need НaHa).

You undoubteԀly put a bгand new spin on a

topic thats bеen written aboᥙt for years. Nice stuff, simply great!

Stop by my web blog – Comprehensive cultural hub

Rocket Pool The Top Crypto Platform in 2025

I am really enjoying the theme/design of your weblog.

Do you ever run into any internet browser compatibility

problems? A number of my blog audience have complained about my blog not working correctly in Explorer but looks great in Chrome.

Do you have any advice to help fix this problem?

Thanks for your feedback! We’re glad you like the theme and design. Our professional team specializes in premium and custom themes, all built on Elementor for seamless performance. If you’re facing browser compatibility issues, especially with Internet Explorer, our experts can help. Feel free to reach out to us at admin@ukblogging.com, and we’d be happy to assist you!

Appreciating the time and energy you put into your website and in depth information you provide.

It’s great to come across a blog every once in a while that

isn’t the same outdated rehashed information. Excellent read!

I’ve saved your site and I’m adding your RSS feeds

to my Google account.

Really appreciate your support! Glad you’re enjoying the content. Stay tuned for more insights on the UK real estate market—more great stuff is coming your way!

Nice blog right here! Also your site so much up very

fast! What web host are you using? Can I

get your affiliate link in your host? I desire my website loaded up as fast as yours lol

Thanks for the compliment! I’m using Hostinger for my website, and it has been great for speed and performance.I hope it helps your site run as smoothly as mine.

Hello my family member! I wish to say that this article is awesome, great written and include approximately all

important infos. I’d like to see extra posts like

this .

Thank you for your kind words. I’m glad you found the article helpful and informative. I’ll definitely keep sharing more valuable content like this. Stay tuned for upcoming posts

continuously i used to read smaller articles or reviews which as well clear their motive, and that is also happening with this

piece of writing which I am reading at this time.

Excellent goods from you, man. I have understand your stuff

previous to and you’re just too great. I actually like what you have acquired here, really like

what you’re stating and the way in which you say it.

You make it entertaining and you still care for

to keep it wise. I can’t wait to read much more from you.

This is really a terrific web site.